Nationwide Alert

Nationwide Alert

TheTruthAboutPreexistingConditions.com

The Illinois Policy Institute has teamed up with the Liberty Justice Center to seek plaintiffs for a lawsuit against the PPACA – Patient Protection and Affordable Care Act – a.k.a. “Obamacare”. It will take every legal and legislative avenue at their disposal to stop Obamacare. Your information will be totally confidential, and there is no cost involved.

They’re looking for people to join a lawsuit that will challenge an IRS rule that extends Obamacare health insurance subsidies and the Obamacare “employer mandate” to states like Illinois where they shouldn’t apply because the state government hasn’t established its own insurance exchange.

As a result of this unlawful IRS rule, many people who would otherwise be exempt from the Obamacare individual mandate will be forced to buy insurance they don’t want. You may be eligible to participate in their lawsuit if you:

- Are a resident of Illinois or any of the following states: AL, AK, AZ, AR, DE, FL, GA, ID, IN, IA, KS, LA, ME, MI, MS, MO, MT, NE, NH, NJ, NC, ND, OH, OK, PA, SC, SD, TN, TX, UT, VA, WV, WI, or WY;

- Are ineligible for Medicaid;

- Have not been offered Obamacare-compliant health benefits from an employer;

- Are a nonsmoker;

- Have a household income between 100% and 400% of the federal poverty level in 2014 ($11,490 to $45,960 for a single person — see this chart for other household sizes); and

- Do not want to buy insurance for 2015 or, if you are 30 or over, either do not want to buy insurance or plan to purchase a catastrophic plan for 2015.

If you meet these criteria and are interested in helping us take our case to court — at no cost to you — please call Jacob Huebert at 312.263.7668, extension 219 or email him at jhuebert@libertyjusticecenter.org.

Fill out this short survey to get started. Please respond no later than Friday, January 31, 2014

————-

State-based exchanges and federally facilitated exchanges

Section 1311 of the PPACA describes state-based health insurance exchanges. That section outlines the powers granted to the IRS to provide APTC – “Advance Premium Tax Credits” (a.k.a. ‘subsidies’) that will be used to artificially lower the high cost of health insurance offered in a state-based exchange. Tied to those APTC’s is also the power granted to the IRS to levy a $2,000 or $3,000 excise tax (non-tax deductible) on all employers with 50 or more full-time employees (first 30 employees waived) if they do not provide PPACA approved health insurance. This is a lot of new power granted to the IRS and this is the primary reason the IRS is hiring thousands of new agents.

Section 1321 of the PPACA describes federally-facilitated exchanges and state-federal partnership exchanges – like the exchange the state of Illinois has chosen to establish. In these types of exchanges, the IRS is granted no authority to provide APTC’s or to levy excise taxes on any employer in that state for not providing PPACA approved health insurance. Since the crafters of the PPACA assumed that every state would willingly establish a state-based exchange, there was no money appropriated for federally-facilitated exchanges. Thus far 34 states have chosen not to open a state-based health insurance exchange.

The illegal action taken by the IRS

Here’s the kicker, in order to ‘fix’ this legal ‘opt out’ that section 1321 provides to states that choose not to open a state-based exchange. The Internal Revenue Service finalized a proposed rule on the 2 year anniversary of the passage of the PPACA that offers APTC’s -Advance Premium Tax Credits – through exchanges “established under section 1311 OR 1321 of the PPACA. Those six characters—”or 1321?—constitute an unconstitutional and as such illegal rewriting of the statute. By issuing tax credits where Congress did not authorize them, this rule also triggers APTC’s “subsidies” and imposes excise taxes on employers with 50 or more full-time employees in all 50 states with either a state-based, state-federal partnership or federally facilitated exchange. Since the IRS is not a Legislative branch, this action was an illegal action not authorized by Congress and it must not stand.

Worse yet President Obama is following that new proposed rule that was written by the IRS as if it was codified law. This illegal action and President Obama’s support of it has prompted Oklahoma Attorney General E. Scott Pruitt to amend his lawsuit to include a section that sues the IRS for illegally writing new law and granting itself power that it was not granted in the PPACA as originally written. Read more about Mr. Pruitt’s lawsuit here. Mr. Pruitt sat down with Fox News’ Sean Hannity to discuss the progress of his pending case against the IRS on December 6, 2013. Watch the interview below:

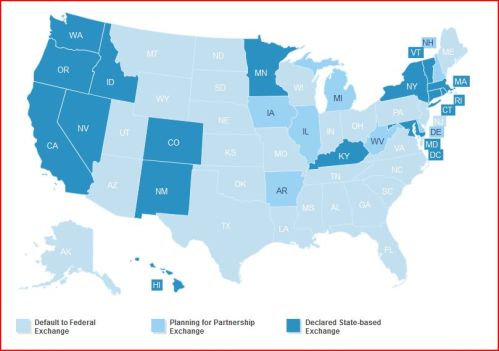

As of May 28, 2013 here’s where the numbers stand:

- Committed to a state-based exchange: 17 states and Washington, D.C. (described in section 1311)

- Planning for a partnership exchange: 7 states (described in section 1321)

- No to state-based exchange. Defaulting to Federal Exchange: 27 states (described in section 1321)

I recently commented about this illegal action taken by the IRS for Champion News talk radio on Chicago’s AM560TheAnswer radio:

I thought this was a free country then we get Obama now we have to pay 500 to 800 per month because of asshole Obama we live pay check to pay check lets put a stop to this we work hard for money now we have to get this abortion bs insurance or pay the fine so the government can get richer and have bonuses and go on trips